The tax reform that took place in the United States in 2018 has created extensive changes in the aspect of taxation that applies to individuals, the taxation that applies to companies, and in the aspect of international taxation.

In the article before you, we will review the new tax regime applied to shareholders in foreign controlled companies, a regime known as controlled foreign corporation, and in short- CFC. We will understand what a foreign controlled corporation is and what the new tax liability applies to it.

Who shall find this information relevant?

Before we dive into a comprehensive explanation about the nature of the CFC, we will list the entities affected by the new reform provisions:

- American citizens (even if they do not reside in the United States).

- People in possession of a green card (even if they do not currently live in the United States).

- American companies (of any type).

- Israelis who own Exchange Traded Funds (ETF) in the United States.

What is a Controlled Foreign Corporation?

A Controlled Foreign Corporation is a company incorporated by the law of a country other than the United States that is actually under American control.

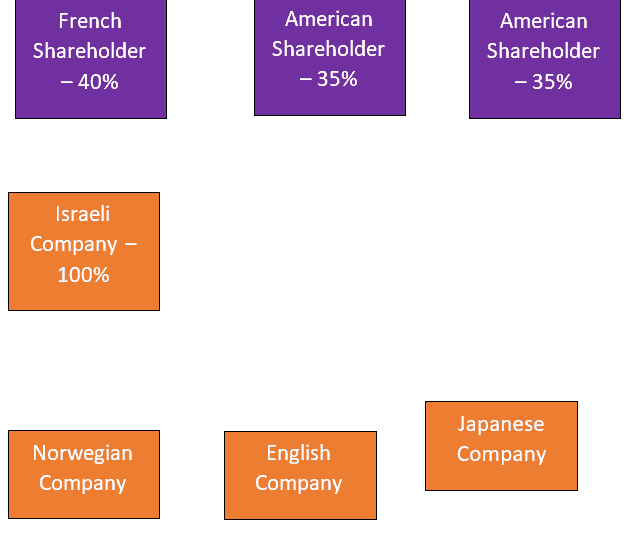

According to the definition of the law, a foreign controlled company is a company incorporated under foreign law and whose 50% shares are held by American shareholders (whether individuals or companies), each of whom holds at least 10% of the shares. This means that if the parent company is a foreign controlled company, and it holds 100% control over subsidiaries, the subsidiaries are also foreign controlled companies.

In the illustration before you, American shareholders each hold shares at a rate that exceeds 10%, and together hold 60%. Hence, the Israeli company and all its subsidiaries (over which it has full control) are controlled foreign companies (the orange companies in the chart).

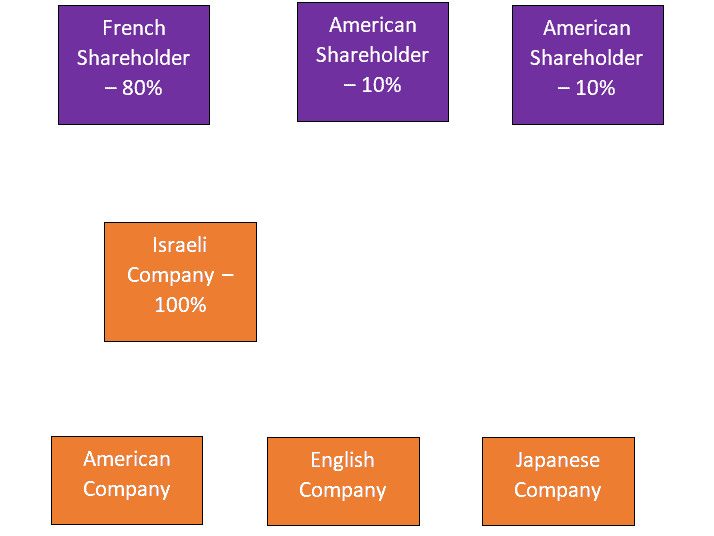

Furthermore, the reform expanded the definition mentioned above, and so, even if American shareholders each held only 10%, which does not add up above 50%, if one of the subsidiaries were American, the Israeli company and the other subsidiaries would be considered controlled foreign companies as well.

What is the reasoning that led to imposing the new tax?

A regime that does not enforce tax rules on controlled foreign companies effectively allows the deferral of U.S. taxation on the profits of foreign companies until the time of dividend distribution, and in fact bypasses the taxation mechanism. The new CFC rules, which were established under the tax reform, are designed to limit the artificial tax deferral through the use of controlled foreign companies.

In other words, the new tax is intended to ensure the payment of tax to the U.S. Tax Authority for profits generated by American entities through control of foreign companies, and which until now American entities refrained from transferring them to the United States and paying tax for them.

Taxation of Controlled foreign corporation (CFC)

The taxation of CFC companies has two components or in fact two separate liabilities: a one-time tax on surplus profits and an annual tax on income from intangible assets. The following segments will breakdown the new liabilities:

A one-time tax on Controlled foreign corporation surpluses profits

The liability applies to surplus profits that have not yet been distributed in any foreign company defined as CFC (a foreign company that is actually under American control, as detailed above), or alternatively a foreign company whose 50% of its shareholders are American entities.

This is a one-time tax liability, a kind of forced dividend distribution, which can be paid during the eight years following the reform, that is 2026.

The tax rate on surplus profits is 15.5% for cash and cash equivalents, and 8% for other profits of the foreign company.

GILTI (Global Intangible Low Taxed Income)

An annual tax applicable to the income of a foreign controlled company. The tax actually expands the category of taxable income in all of these controlled foreign companies (including income derived from intellectual property, income that has not yet been taxed). Tax rates will be determined as follows:

When the shareholder is a company

The tax will be calculated from the income of the foreign company, deducting expenses and 10% of the value of the company’s fixed assets. The effective tax rate will be 10.5 percent by 2026, after which it will be 13.125 percent. The company will be entitled to a tax credit at a rate of up to 80 percent of the tax paid by the foreign company in the country of origin.

When the shareholder is an individual

The tax rate will be the marginal tax rate that applies to him or her in accordance with his or her income – between 10-37%. The individual has a choice to tax GILTI revenues as a company (as described above).

The upside of the reform: Tax exemption for dividends from a foreign company for American companies

As noted, the purpose of the reform is to prevent the accumulation of profits while deferring tax. Therefore, the reform included a benefit designed to encourage dividend distribution from foreign companies. Thus, the reform established a full exemption for American companies from paying tax on dividends distributed to them from foreign companies.

Closing words

Do you hold dual citizenship and own an Israeli company? Do you invest in American exchanged traded funds? Do you own an American company that controls other Israeli or foreign companies?

The MasAmerica team is familiar with the new tax provisions and will be happy to advise you on solutions that will minimize your tax liabilities.

This should not be seen as legal advice. It is recommended to consult with the team of MasAmerica before any action. The service is provided by a professional team, who speak English and Hebrew fluently, and includes lawyers and accountants with American licensees.